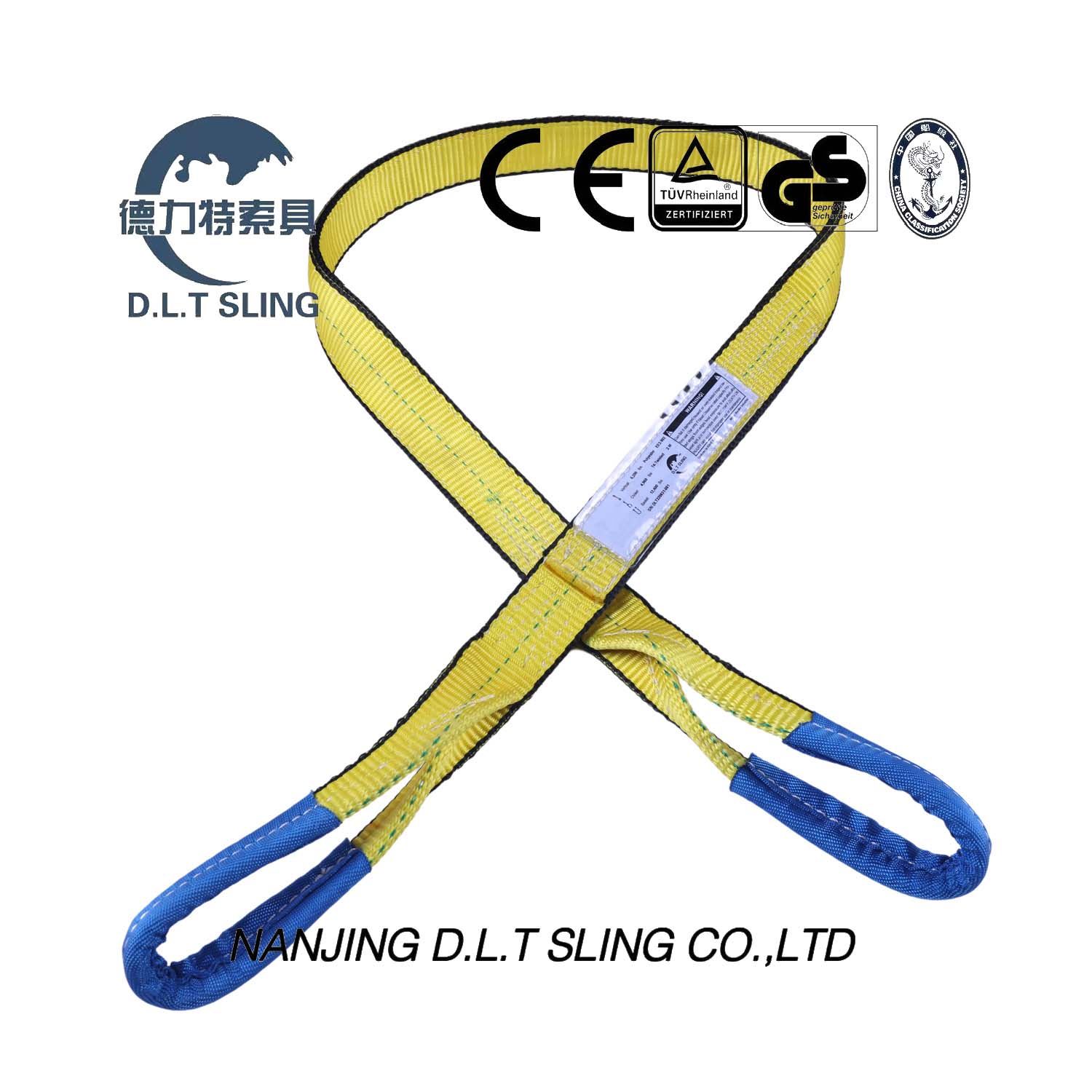

What Is a Duplex Webbing Sling?

A duplex webbing sling is a high-strength, flexible lifting sling made from two layers of durable synthetic webbing, commonly used for heavy lifting and secure load handling. These slings are widely preferred in industries such as construction, logistics, and manufacturing due to their lightweight, strong load-bearing capacity, and excellent safety features.

High Strength & Durability

Duplex webbing slings are made from high-quality polyester ,offering excellent load distribution and resistance to wear, UV exposure, and moisture.

Flexible & Lightweight

Unlike chain slings or wire ropes, webbing slings are softer and more flexible, reducing damage to delicate loads while being easier to handle and store.

Increased Safety

With a high safety factor (typically 7:1), duplex webbing slings provide a secure and reliable lifting solution, minimizing the risk of load slippage or failure.

Customizable & Versatile

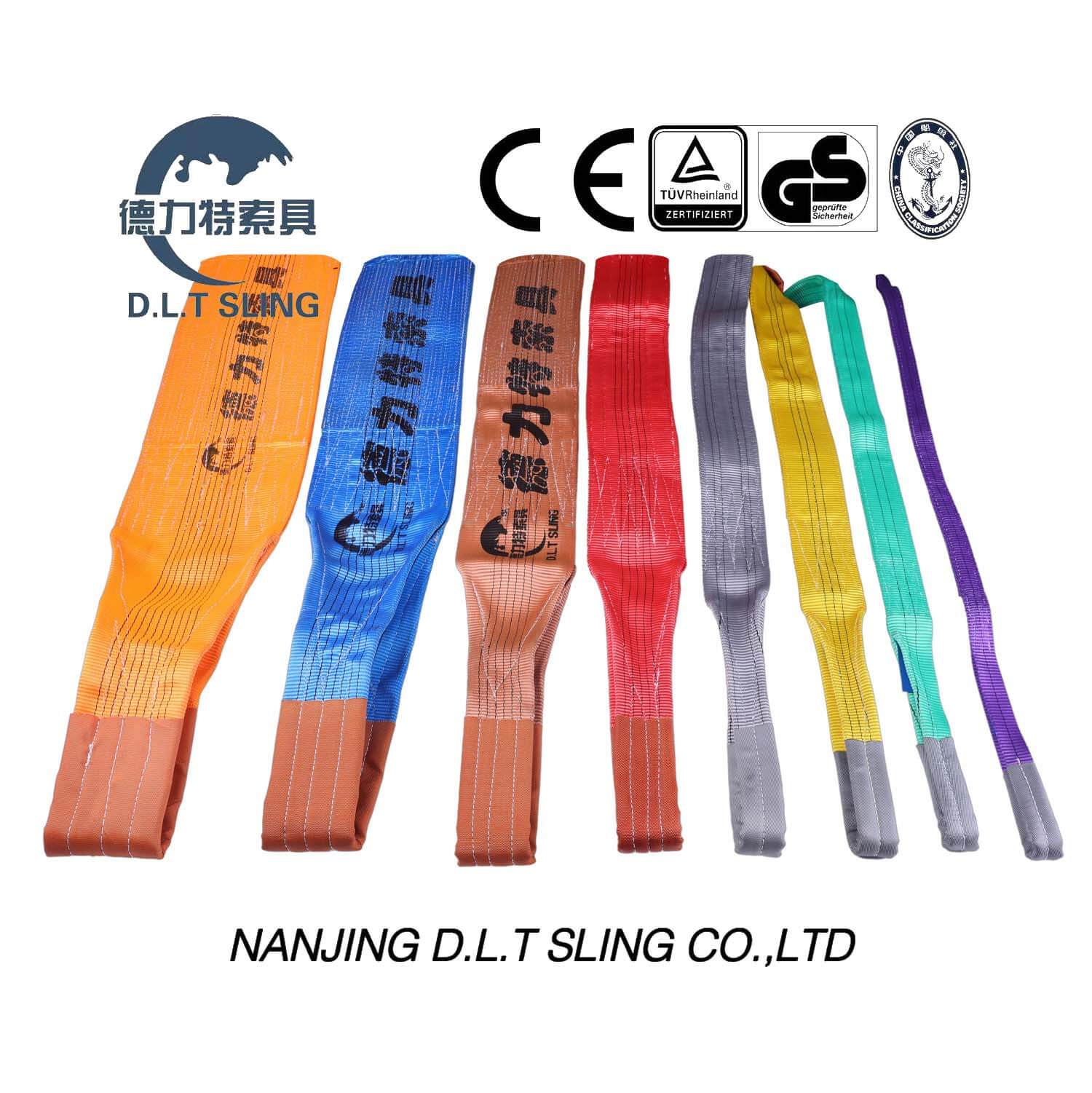

Available in various lengths, widths, and capacities, these slings can be color-coded for easy identification, ensuring efficient operations on-site.

Where Are Duplex Webbing Slings Used?

· Construction & Infrastructure – Lifting steel beams, precast concrete, and heavy machinery.

· Shipping & Logistics – Securing and lifting cargo safely.

· Manufacturing & Engineering – Handling components with precision and care.

· Automotive & Aerospace – Moving delicate parts without surface damage.

Find the Best Duplex Webbing Sling for Your Needs

At NANJING D.L.T SLING, LTD, we manufacture high-quality duplex webbing slings that meet international safety standards. Our slings are CE and GS certified, ensuring reliability in demanding industrial environments. Contact us today to get expert advice on selecting the right lifting sling for your business!

📩 Get in touch with us today for a free consultation!